19: Important Financial Decision Maker — Part One

Background

A friend put his cat on life-support for over $10,000. And his cat survived after nearly 2 months.

Amazing story, but an debatable decision, as he still carries student loan, pays rent, and still tries to save more.

No one in any position to judge this decision is right or wrong, since everyone has different feeling to different things. Something may be worthy to someone, but may be given up by a different person.

Machine Learning for making Financial Decision

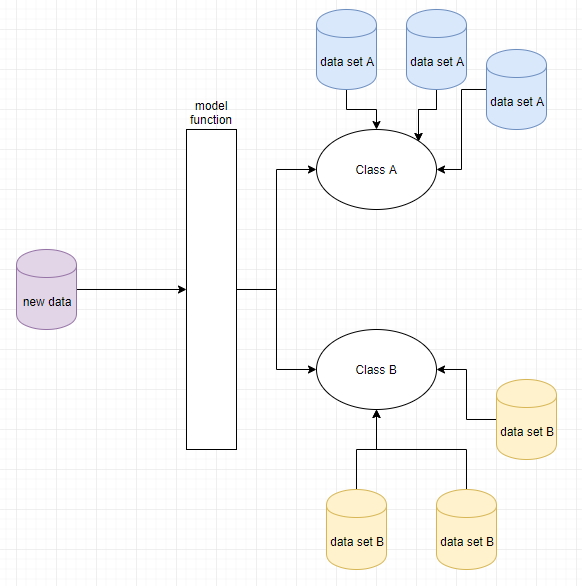

If you think about financial decision, it is fundamentally a classification problem, which is a much easier problem to solve compared to deep learning or Neural Networks. A simple classification problem can be seen as:

We provide a set of data and we say they always yield the result “Class A”, and then provide a different set of data and we say they always yield the result “Class B”. Next pick a function (linear or non-linear) to train with those 2 set of data. Under the hood, it’s going to refine some parameters of the function. Think about “ax + by = C”. The idea is to get the parameter “a” and “b” as best as they can.

After that is done, now feed the function with a new set of data, which will yield a result of either class A or B. With additional cross-validation, some training model can have a probability to support the result. Sometimes a classification problem may yield multiple classes. Generally, this kind of solution yield better results with more data.

With this superficial introduction of one kind of machine learning, now if we look at the financial decision problem, isn’t it just a simple 2-class problem:

- Do it, or

- Don’t do it

Training Data Set

As long as we can remove emotion from the equation, this should not be too complicated.

To prepare our training data, we can simply list some hard data, including:

- debts

- assets

- income

- life-time goal

Someone needs to calculate and determine a weighted point with each pair of those data. For example, if debt is higher than income, a higher weight for NO-class is given. And then we can (probably) easily train a model for making financial decision.

Now, if I want to know if I should buy a new car. By providing my current financial situation, this application should tell me a YES or NO question. Of course, something like buying a car may require additional data, like do I have a functional car already, and how much do I like my car?

The latter is tricky.

Why there is NO such a thing?

If data can really help us solve this problem, why there is no such a thing?

First, emotion or feeling is tricky and impossible to calculate.

At least in most case.

If someone has no income but rather pay a high pet medical bill with credit card, that is not really applaudable. But if someone has stable income and feeling to the thing he or she is paying for, then there is no formula can be used to calculate.

Second, human has rationale. At least for most people when they are not drunk.

I have a car now. It is very old, 2005 Element. In summer time it has a squeaky sound that drives me nuts. I have been thinking to get a new car, but my current car is still functional and I also have spent a lot of money to fix its old problems. Financially I can support myself to get a new car, however, I really see no strong reason to get a new car at all.

How can we rely on computer to factor emotion and rationale? At least I have no knowledge how this can be achieved.

Conclusion

This time I kind of have an idea, but honestly this is not a useful idea. Rather, it’s like a thought.

Can neural network or deep learning really calculate human feelings and rationale? I do not know. But at least, I don’t think data can solve it.

To make important financial decision, we probably still should rely on human sense. Of course there is finance adviser, but they just want to make money from you. So always rely on yourself for important financial decision and trust no one.